Personnel Salary Calculation

Accurate and detailed calculation of personnel salaries is critical for ensuring efficiency in personnel management and fair payment of the personnels due salary. This document provides a detailed guide on the definitions, wage calculation formulas, and functions that can be used on this screen for the personnel salary calculation process.

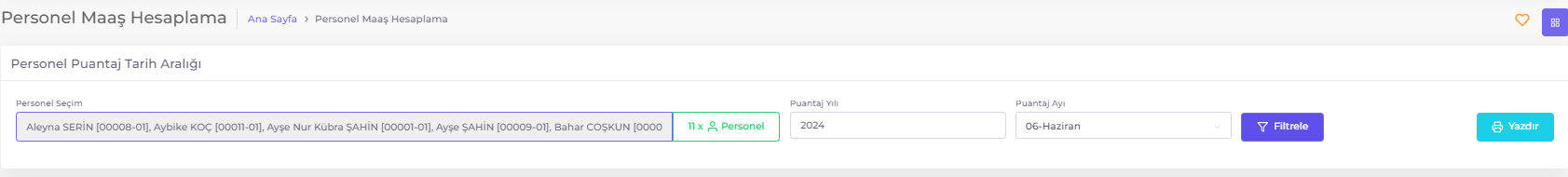

Personnel Salary Calculation Screen

The personnel salary calculation screen allows the calculation and monitoring of personnel salaries through specific filtering fields and detailed tables. With this screen, users can perform salary calculations and examine the related data in detail using various filters such as personnel selection, attendance year, and month.

Salary Calculation Filtering Fields

- Personnel Selection: Used to select specific personnel. The selected personnel are listed and displayed in the Salary Calculation table according to other filters.

- Attendance Year: You can select the year of the month you want to examine.

- Attendance Month: By selecting a specific month, you can view some attendance information and salary calculations for that month.

- Search in List: Allows filtering by a specific keyword in any field of the listed table.

- Column Filters: The search field under each column header. Filters based on the text or numbers entered for the respective column.

- Selection of Fields to be Displayed in the Table: By clicking on the icon at the top right corner of the Personnel Attendance Information table, you can select the fields you want to be displayed in the table.

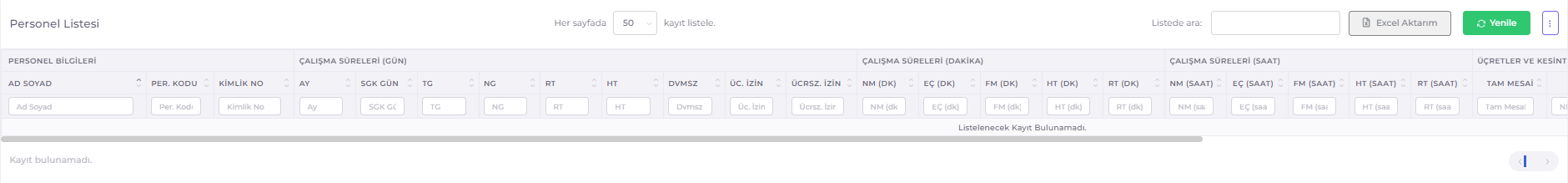

Personnel Salary Calculation Table

- Work Durations (In Days)

- Month: Number of days in the selected Attendance Month.

- SGK Days: Number of days considered by SGK for a month.

- TG (Total Days): Total number of charged days for the selected Attendance Month.

- NG (Normal Days): Total number of normal working days in the selected Attendance Month.

- RT (Official Holiday): Total number of Official Holiday days in the selected Attendance Month.

- HT (Weekly Holiday): Total number of Weekly Holiday days in the selected Attendance Month.

- Absentee (Absent): Total number of absentee days of the personnel in the selected Attendance Month.

- Paid Leave: Total number of Paid Leave days of the personnel in the selected Attendance Month.

- Unpaid Leave: Total number of Unpaid Leave days of the personnel in the selected Attendance Month.

- Work Durations (In Hours and Minutes)

- NM (Normal Working Hours): Total completed Normal working hours of the personnel during the selected attendance month.

- Incomplete Work Hours: Total incomplete work hours of the personnel during the selected attendance month.

- Overtime Hours: Total Overtime hours of the personnel during the selected attendance month.

- Weekly Holiday Hours: Total weekly holiday hours of the personnel during the selected attendance month.

- Official Holiday Hours: Total official holiday hours of the personnel during the selected attendance month.

- Wages and Deductions

- Full Working Hours: Full Working Hours shows the personnel's daily full working hours wage for the selected attendance month.

- NM (Normal Working Hours Wage): Shows the personnel's Normal working hours wage for the selected attendance month.

- Overtime Wage: Shows the personnel's total Overtime Wage for the selected attendance month.

- Weekly Holiday Overtime Wage: Shows the personnel's total Weekly Holiday Overtime Wage for the selected attendance month.

- Official Holiday Overtime Wage: Shows the personnel's total Official Holiday Overtime Wage for the selected attendance month.

- Advance Payment: Shows the total advance payments received by the personnel during the selected attendance month.

- Total: Shows the total amount of wages calculated for the selected attendance month.

Personnel Salary Calculations

In this section, we will examine the basic elements necessary for correctly determining the personnel's salary and how to combine these elements.

Basic Elements of Personnel Salary Calculation

The personnel salary calculation considers Personnel's Wage, Personnel Attendance, and Personnel's Employment Contract:

-

Personnel's Wage: It is the amount recorded for the personnel in Personnel Wage Management. The amount and type of wage determined here are taken into account in the calculations. For example:

- For a personnel with a Wage Type of Monthly and Wage Amount of 25,000, the calculated monthly wage under default settings and normal working conditions will be 25,000.

- For a personnel with a Wage Type of daily and a Wage Amount of 1,000, the calculated monthly wage will be 30,000.

-

Personnel Attendance: The attendance table calculations and work notes of the personnel express the characteristics of the work period to be charged.

- For example: Normal working hours, overtime, incomplete work hours, weekly holiday work, official holiday work, leave status, absenteeism status, such attendance calculations, and work notes form the basis of the calculations.

-

Personnel's Employment Contract: These are the Employment Contract Information associated with the personnel. Displayed in the Personnel Information > General Definitions Tab > Personnel Employment Contract field for the selected personnel.

- Employment Contract Information is referenced in Attendance Calculations and Salary Calculations.

- Wage Parameters and adjustments determined in the Employment Contract are referenced in the calculation of personnel salaries.

Personnel Working Hour Wage Calculations

Normal Working Hours Definition: It is the amount of the time to be completed according to the employment contract.

Normal Working Hours Duration Definition: It is the time to be completed according to the employment contract.

Full Working Hours Wage Calculation: Full Working Hours represents the personnel's daily full working hours wage. Calculated according to the Wage Type of the Personnel Salary:

- For Monthly Wages:

Wage amount/SGK Days (30) - For Daily Wages:

Wage Amount=Full Working Hours - For Weekly Wages:

Wage Amount/ 7 - For Hourly Wages:

Wage Amount*Normal Working Hours Duration

Normal Working Hours Wage Calculation: Represents the total wage of the personnel for the selected attendance month. Calculated according to the Salary Calculation Type of the employment contract.

For Monthly Wage Type: (Full Working Hours Wage * 30) - Incomplete Work Hours Wage

For Other Wage Types: (Full Working Hours Wage * Total Days) - Incomplete Work Hours Wage

Overtime Wage Calculation: Represents the total wage of the personnel for the selected attendance month. Calculated according to the Overtime Wage Type of the employment contract:

- For Hourly Wages:

Overtime Hours*Full Working Hours Wage*Overtime Wage Type Rate - For Other Wage Types: (

Full Working Hours Wage/Normal Working Hours Duration) *Overtime Hours*Overtime Wage Type Rate

Weekly Holiday Wage Calculation: Represents the total wage of the personnel for the selected attendance month. Calculated according to the Weekly Holiday Overtime Wage Type of the employment contract:

- For Hourly Wages:

Weekly Holiday Hours*Full Working Hours Wage*Weekly Holiday Overtime Wage Rate - For Other Wage Types: (

Full Working Hours Wage/Normal Working Hours Duration) *Weekly Holiday Hours*Weekly Holiday Overtime Wage Rate

Official Holiday Wage Calculation: Represents the total wage of the personnel for the selected attendance month. Calculated according to the Official Holiday Overtime Wage Type of the employment contract:

- For Hourly Wages:

Official Holiday Hours*Full Working Hours Wage*Official Holiday Overtime Wage Rate - For Other Wage Types: (

Full Working Hours Wage/Normal Working Hours Duration) *Official Holiday Hours*Official Holiday Overtime Wage Rate

Absentee Wage Deduction Calculation: Represents the total wage of the personnel for the selected attendance month. Calculated according to the Absentee Wage Type of the employment contract:

- For Hourly Wages:

Absent Hours*Full Working Hours Wage - For Other Wage Types: (

Full Working Hours Wage/Normal Working Hours Duration) *Absent Hours

Paid Leave Wage Calculation: Represents the total wage of the personnel for the selected attendance month. Calculated according to the Paid Leave Wage Type of the employment contract:

- For Hourly Wages:

Paid Leave Hours*Full Working Hours Wage - For Other Wage Types: (

Full Working Hours Wage/Normal Working Hours Duration) *Paid Leave Hours

Unpaid Leave Wage Deduction Calculation: Represents the total wage of the personnel for the selected attendance month. Calculated according to the Unpaid Leave Wage Type of the employment contract:

- For Hourly Wages:

Unpaid Leave Hours*Full Working Hours Wage - For Other Wage Types: (

Full Working Hours Wage/Normal Working Hours Duration) *Unpaid Leave Hours